Mortgage possession claims rise

Following three years of stability there has been a dramatic rise in mortgage possession claims with both owner-occupier and buy-to-let loans.

Data from the Ministry of Justice reveals that mortgage possession claims have risen by 37 per cent.

This follows a three-year period of stability before an initial increase in Q4 2018. Mortgage orders, warrants and repossessions have grown by 42%, 19% and 11% respectively, relative to Q1 2018.

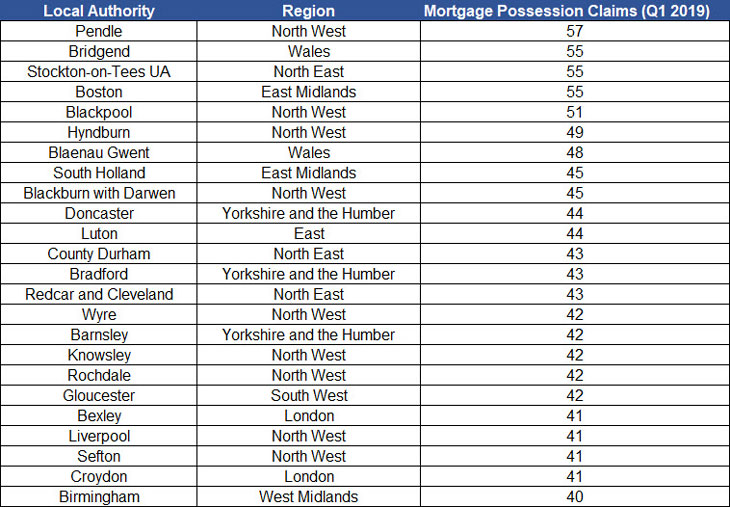

The North West of England (namely Pendle, Blackpool, Hyndburn and Wyre) reported an increased frequency of mortgage possession claims compared to other regions. Luton, Liverpool, Croydon and Birmingham were also in the highest 25.

IS THE LANDLORD EXODUS TO BLAME?

Mark Pilling, MD, Spicerhaart Corporate Sales says that many landlords who have given notice to tenants are now suffering as these tenants stop paying and that residential possessions will continue to rise as borrowers run out of options. “The latest statistics reveal that buy to let possessions are down, but arrears are up. As a result of recent regulatory changes, there are many private landlords looking to get out of the sector – this rise could be down to the fact that some tenants who have been given notice are now not making their rent payments.

“In terms of residential mortgages, arrears are down slightly – although those in arrears of 10% or more remain fairly static – but possessions are up by 10%, a fairly significant increase. And while they are still not at the levels seen after the financial crisis, they are slowly creeping up.

“I think we will see these residential possession numbers continue to increase every quarter, ballooning at the end of the year as borrowers start to run out of options. While forbearance is still an option for some, lenders need to look at all the circumstances of each customer and get the right strategy in place.

IT CAN HAPPEN TO ANY OF US

Co-founder of Property Solvers, and author of the Stop Repossession Guide, Ruban Selvanayagam said, “Despite historically low interest rates and a much stricter approach to lending, this data demonstrates that the risks of falling into mortgage default never really went away. Although it’s hard to pinpoint the exact cause, we often find that illness, unemployment, divorce or excessive consumer debt all come into play. The truth is that any of us could fall into such a situation.”

PRE-ACTION PROTOCOL

“Lenders are governed by the Mortgages and Home Finance: Conduct of Business Sourcebook and must adhere to what’s known as the pre-action protocol. This essentially means that they have a legal obligation to treat homeowners fairly and discuss their financial situation in an honest manner.

“As a borrower, you must also be given a sufficient amount of time to clear your arrears. We always urge people to communicate regularly with their lender. Burying your head in the sand will only make matters worse. If you can pay down at least some of what you owe and work towards clearing the arrears, you’ll be ok.”

See details of our Guaranteed Rent Scheme here

If you have any comments, please email the author of this article and click on the link above