Generation Rent: London to become a city of renters by 2025

New research has revealed that 60pc of Londoners will be renting in nine years’ time

London will become a city of renters, with just 40pc owning their own home in 2025, according to new research from PwC.

This is a reversal of the situation in 2000, when 60pc of Londoners owned a house, either outright or with a mortgage.

PwC’s forecast of the continuation of ‘generation rent’ will come as bad news to many, including the government, which has been attempting to create a nation of homeowners by artificially boosting the market with schemes such as Help to Buy. George Osborne, the Chancellor, is also penalising landlords by raising stamp duty on buy-to-let properties from April.

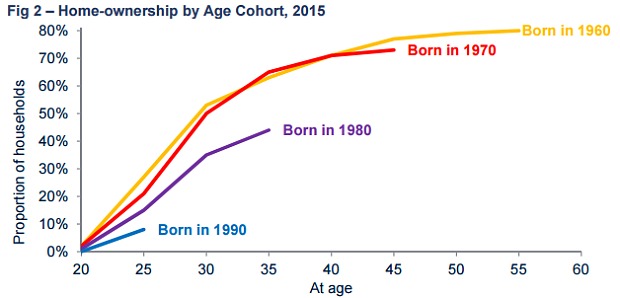

Locked out by high prices and unattainable deposits and mortgages, young people will be the hardest hit: just 26pc of those currently aged 20-39 will own their own home by 2025.

This compares with 64pc of households born in 1960 and 1970 who owned a house by the time they were 35.

The rental rate will be highest in London, with a forecast 24.4pc rise in the number of people privately renting in the capital between 2000 and 2025, while in the UK as a whole it will rise by 14.5pc.

Due to low interest rates, those with mortgages are seeing falls in their housing costs, compared to renters, and especially in London. The Resolution Foundation said in a new report “that measured before housing costs, median incomes in London appear to have grown by 2.9pc post-crisis; measured after housing costs, they remain 3.7pc below pre-crisis levels.”

Renting is predicted to increase in every region of the UK; Northern Ireland will see the next biggest growth of renters, at 24.4pc, driven by low levels of house building and a younger population. The slowest growth will be in the South West, at 6.1pc.

Homeowning in Britain peaked in 2003 at 71pc, and has been declining ever since, according to Neal Hudson at Savills. The height of home ownership was boosted by Right to Buy policies of the 1980s.

Richard Snook, a senior economist at PwC, said: “This analysis shows that people are increasingly being locked out of owning a home in London, demonstrated by the sharp rise in private rental levels and sharp fall in home ownership.

“High prices are making homes in the capital unaffordable to most and could undo a century-long trend towards rising home ownership rates. In just 25 years the city has been transformed to one where rental is becoming the norm – especially for younger people.

Research from the Association of Residential Lettings Agents found that first-time buyers who buy a house this year will have spent on average £52,900 on rent.

But it isn’t all bad news: rents are rising at a much lower rate than house prices, and largely mirror wage growth. Homelet’s most recent rental index revealed that rents in Greater London are rising at the slowest rate in almost two years. Average rent in the UK, excluding Greater London, is £740 a month, with rents in London averaging £1,510 a month.

David Snell, a partner at PwC, added: “With around 60pc of Londoners predicted to be renting by 2025 (40pc private sector and 20pc social housing), policy will need to adapt. This could include encouraging a better quality of private rented accommodation, including longer tenure periods, and more rental properties designed for families.

“Demand for housing in the UK has outstripped supply for more than two decades. Changing the outlook for generation rent will require us to build more houses than needed just to match population growth in order to make up the past shortfall between housing supply and growth in demand.”

Campbell Robb, chief executive of Shelter, said: “Faced with sky high housing costs and instability, and forced to wave goodbye to their dreams of securing a home of their own, the shortage of affordable homes in the capital is putting huge pressure on London’s renters.

“But it doesn’t have to be this way. Many renters in Europe enjoy greater stability, and there’s no reason London’s tenants can’t as well. To turn around this crisis, the next Mayor of London must prioritise longer, more stable tenancies in the capital, and finally commit to building the genuinely affordable homes that Londoners are crying out for.”

- Get bank-beating exchange rates and your first transfer free with the Telegraph International Money Transfer service. Find out more…

See details of our Guaranteed Rent Scheme here

See details of Rent to the Council here

If you have any comments, please email the author of this article and click on the link above