‘Generation Rent’ dominates London property market for the first time

By Katie Morley

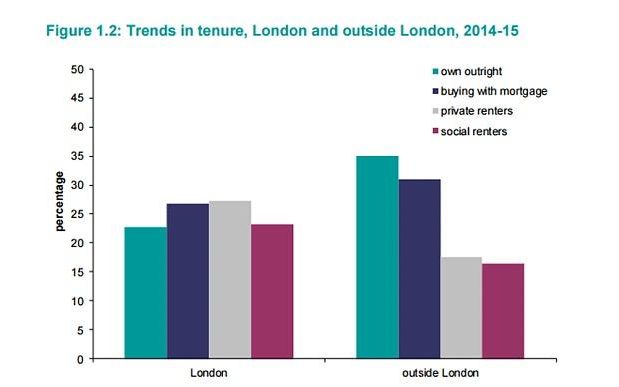

Private renters in London outnumber homeowners for the first time in a more than a decade, official figures show, amid concerns a generation of young families are being permanently priced out of the housing market.

New data from the Government’s English Housing Survey, shows some 898,000 households in the capital are living in privately rented accommodation, more than double the 405,000 households who privately rented homes in 2003/04. By comparison 883,000 households live in mortgaged homes, down 17pc from 1m ten years ago.

Landlords are duping the young into cramped housing – it has to stop

Experts said the combination of lower salaries and soaring house prices meant young families are stuck renting because they are unable to afford a mortgage. Yesterday official figures showed London house prices rose by more than 9pc over the past year, with the average home valued at £536,000.

The trend means London will transform from a city of homeowners to a city of renters within a generation, according to a PwC report published on Tuesday.

“The pressure is on to deliver a greater supply of affordable housing” – David Hollingworth

Ashley Seager, co-founder at the Inter-generational Foundation, a think tank, said: “That the number of under-34s renting has doubled in just ten years, while half of all home-owners are under-occupying, highlights just how intergenerationally unfair our housing market has become.

“Unless the Chancellor takes more action to cool buy-to-let investment further and property-hoarding by older generations, young people will increasingly be left out in the cold.”

David Hollingworth, a spokesman at London and Country, a mortgage broker, said: “The slide in home ownership and corresponding increase in private renters illustrates the difficulties facing aspiring first time buyers. Just as worrying is that the proportion of private renters that expect to buy had dropped year on year. If that trend continues it would suggest a gloomy picture where growing numbers begin to give up on home ownership.

“The pressure is on to deliver a greater supply of affordable housing. The Government has clearly put its flag in the home ownership camp and will need to see improvements quickly. The measures aimed at Buy to Let landlords, in a bid to level the playing field for first time buyers, could result in rents increasing longer term. If that isn’t matched by an increase in ownership options then it could ultimately only add to the difficulty in amassing a deposit.”

A Department for Communities and Local Government spokesman said: “We are determined to create a bigger, better private rented sector and are attracting billions of pounds of investment to build homes specifically for private rent, which will increase choice for tenants. We have also introduced measures to ensure tenants can be confident they will get a fair deal.

“Furthermore with 86% of the public saying they want to own their own home, we want to ensure anyone has the opportunity to do so. That’s why we’ve doubled the housing budget to support the boldest plan for housing by any government since the 1970s, with Government initiatives having already helped nearly 270,000 people to buy since 2010.”

- One minute mortgage check: How much could you save?

- To contact the writer, email [email protected]

- The best of Telegraph Money: get our weekly newsletter

See details of our Guaranteed Rent Scheme here

See details of Rent to the Council here

If you have any comments, please email the author of this article and click on the link above